Facts About Feie Calculator Uncovered

Wiki Article

All about Feie Calculator

Table of ContentsThe Best Strategy To Use For Feie CalculatorExamine This Report about Feie CalculatorFeie Calculator Can Be Fun For AnyoneWhat Does Feie Calculator Do?The Basic Principles Of Feie Calculator

He marketed his U.S. home to establish his intent to live abroad completely and used for a Mexican residency visa with his partner to assist fulfill the Bona Fide Residency Examination. Neil aims out that purchasing property abroad can be challenging without first experiencing the place."It's something that people require to be actually persistent about," he states, and encourages deportees to be careful of common mistakes, such as overstaying in the United state

Neil is careful to mindful to U.S. tax united state tax obligation "I'm not conducting any business any kind of Service. The U.S. is one of the couple of nations that taxes its people regardless of where they live, meaning that also if an expat has no income from United state

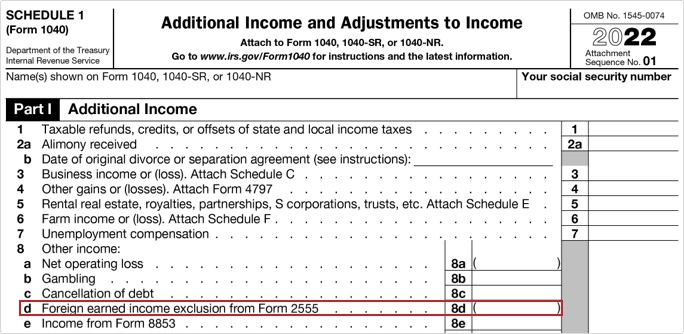

tax return. "The Foreign Tax obligation Credit rating enables people working in high-tax nations like the UK to counter their United state tax liability by the amount they've already paid in taxes abroad," says Lewis.

The Best Guide To Feie Calculator

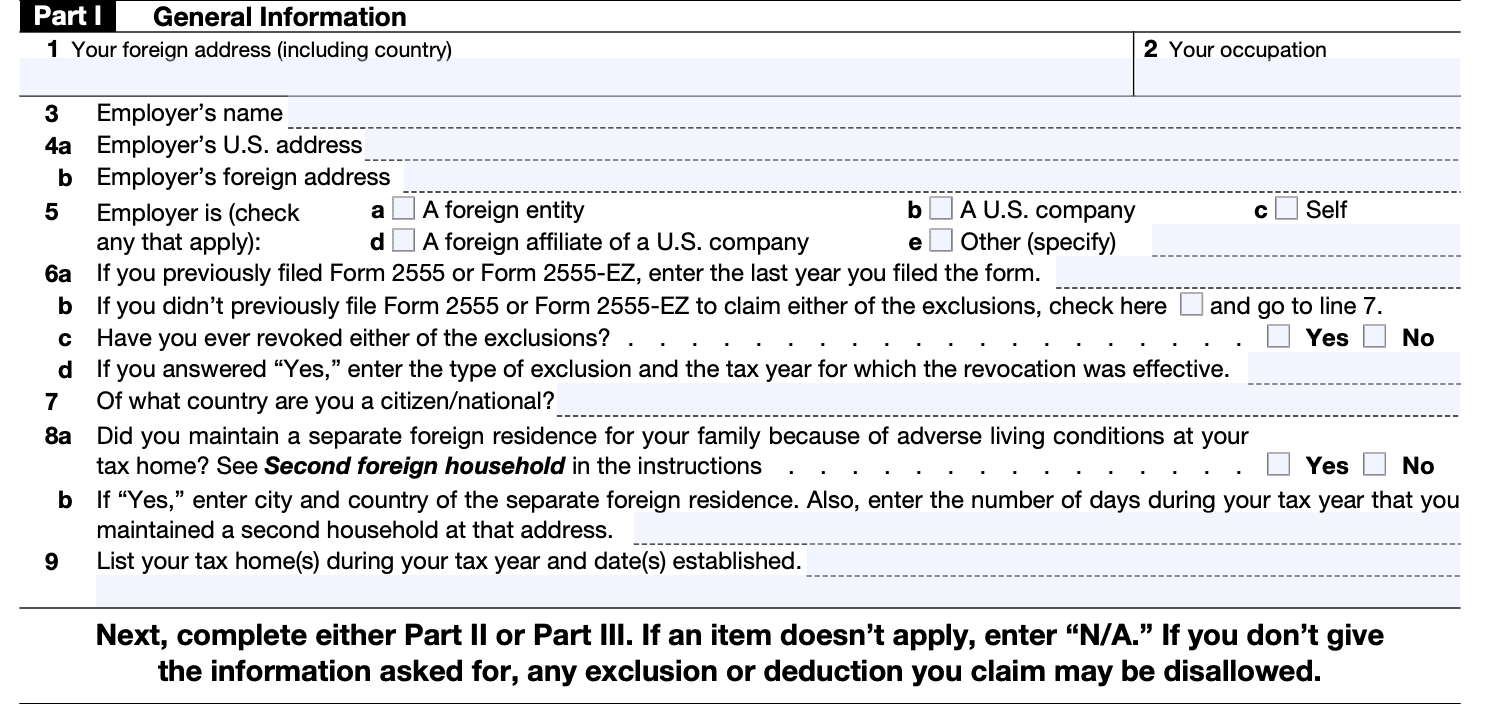

Below are a few of the most often asked inquiries about the FEIE and other exemptions The International Earned Income Exclusion (FEIE) enables U.S. taxpayers to exclude as much as $130,000 of foreign-earned earnings from government earnings tax, reducing their united state tax liability. To certify for FEIE, you need to meet either the Physical Presence Test (330 days abroad) or the Authentic Home Examination (show your primary house in a foreign article nation for an entire tax year).

The Physical Existence Test likewise calls for U.S (Physical Presence Test for FEIE). taxpayers to have both an international income and a foreign tax obligation home.

Unknown Facts About Feie Calculator

An income tax treaty in between the united state and one more country can aid prevent double taxes. While the Foreign Earned Earnings Exclusion lowers gross income, a treaty may give fringe benefits for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a needed filing for U.S. people with over $10,000 in foreign economic accounts.Eligibility for FEIE depends on conference specific residency or physical existence tests. He has over thirty years of experience and currently specializes in CFO solutions, equity settlement, copyright tax, marijuana tax and divorce associated tax/financial preparation matters. He is a deportee based in Mexico.

The foreign earned revenue exclusions, in some cases described as the Sec. 911 exemptions, leave out tax on salaries earned from functioning abroad. The exemptions comprise 2 components - a revenue exclusion and a real estate exclusion. The following FAQs talk about the benefit of the exclusions consisting of when both partners are expats in a general manner.

Indicators on Feie Calculator You Should Know

The revenue exclusion is currently indexed for rising cost of living. The maximum yearly income exclusion is $130,000 for 2025. The tax obligation advantage omits the income from tax obligation at lower tax obligation prices. Previously, the exclusions "came off the top" lowering revenue topic to tax obligation on top tax rates. The exemptions may or might not decrease income used for various other functions, such as IRA restrictions, child credit scores, personal exceptions, etc.These exclusions do not excuse the wages from US tax however simply give a tax obligation decrease. Keep in mind that a bachelor working abroad for every one of 2025 who gained about $145,000 with no various other revenue will certainly have gross income minimized to absolutely no - effectively the very same response as being "tax complimentary." The exemptions are calculated every day.

Report this wiki page